Opportunities and challenges of exporting East African avocados to Europe

The European market for avocados continues to grow, and so does global production. Latin America dominates the supply to Europe with increasing exports. But Africa is following a similar trend. What are the opportunities and challenges for emerging suppliers in Africa?

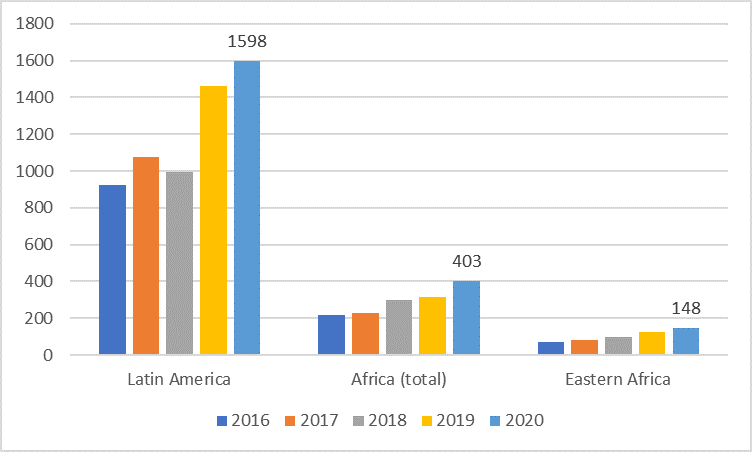

Latin America is the biggest avocado supplier to Europe. After years of strong growth, they supply almost 75% of total European imports, valued at 2.15 billion euros. Africa has grown at a similar rate, if not faster. The main suppliers to Europe are South Africa, Kenya and Morocco. Kenya leads the supply from East Africa. This region exported 148 million euros worth of avocados to Europe in 2020.

Seasonal gap offers opportunities

Peru currently dominates the avocado supply to Europe. The East African avocado season is similar to the Peruvian season, but it starts earlier and finishes later. Figures show that European buyers are interested in African avocados, especially in the early and later parts of the season. In March, the avocado season has not yet started in Peru. This offers opportunities for suppliers from Kenya, Tanzania and Mozambique, where the season begins in February.

In September, Peruvian supply runs out. But Kenya and Tanzania still have avocados available. This provides an opportunity before importers transition to suppliers from Chile and Mexico, then Colombia, Israel and Morocco, and finally Spain.

Quality problems create challenges

In East Africa, the climate is favourable, production costs are low, and the physical distance to the market is reasonable. But, becoming a preferred supplier to Europe takes more than competitive prices and a seasonal gap. Quality problems have affected the reputation of East African avocados. This is due to the long transit times, issues in the supply chain, and the large number of outgrowers.

Figure 1: Origin of European avocado import, in million euros

Data source: ITC Trade Map

Smallholder farming and compliance issues create many challenges in East Africa. Exporters in the region mainly source their avocados from smallholder farms. The technical assistance to these farms has improved significantly. But European buyers still encounter problems that affect the marketability of the fruit. Poor growing practices in wet periods increase the chance of the disease anthracnose. Another issue is the lack of homogeneity of the fruit. This makes ripening in Europe more difficult. There are also practical issues; for example, getting certified in Zimbabwe is expensive. There are no local certification institutes for required standards such as GLOBALG.A.P. or other food safety and sustainability standards.

Logistics issues and developments

Another issue is logistics. The transit time of East African avocados is relatively long compared to other exporting countries. Often, avocados have to travel a long way from the fields to the packing house and the port. Mombasa is the main port for avocados from Kenya and Tanzania, but the available shipping options are limited. Most freight lines have transhipments, and there is no weekly, direct refrigerated container service. Exporters have to send fruit with acceptable maturity but prevent it from ripening in transit; this is not easy.

Many exporters have improved their cold chain management and use refrigerated containers straight from the packing house. In Ethiopia, a new cool logistics corridor of train and sea freight resulted in the first successful avocado exports to Europe in 2020. Developments like these are necessary to make the avocado supply from East Africa more efficient and compatible with European demand.

Despite the increasing export, East Africa is still not the preferred origin for many European buyers. Exporters need to keep working on the reputation of East African avocados.